International travel gets expensive fast, and currency exchange fees can quietly drain your budget before you even realize what’s happening. Those seemingly small percentages and ‘convenience charges’ add up to serious money over the course of a trip.

Smart travelers know that a little planning and the right strategies can save hundreds of dollars on exchange rates and fees.

The currency exchange game has its own rules, and knowing them puts money back in your pocket instead of in the bank’s coffers.

Here is a list of 15 currency exchange tips that can help you keep more of your hard-earned cash.

Skip Airport Exchange Counters

Airport currency exchanges are convenient, but they’ll cost you dearly for that convenience. They typically offer rates that are 5–10% worse than what you’ll find elsewhere, plus they often charge additional fees on top of poor rates.

Plan ahead and exchange money before you travel, or wait until you reach your destination to find better options.

Use ATMs Instead of Exchange Services

ATMs generally offer the best exchange rates available to regular consumers, often within 1–2% of the actual market rate. Your bank will charge a foreign transaction fee, but it’s usually much less than what currency exchange services charge.

Just make sure to use ATMs connected to major banks rather than standalone machines in tourist areas.

Notify Your Bank Before Traveling

Nothing ruins a trip faster than having your card blocked for ‘suspicious activity’ in a foreign country. Call your bank a few days before departure to let them know your travel dates and destinations.

This simple step prevents your account from being frozen and saves you from expensive international phone calls to sort things out.

Like Travel Pug’s content? Follow us on MSN.

Compare Exchange Rates Online First

Exchange rates fluctuate constantly, so knowing the current rate helps you spot a good deal versus a rip-off. Check rates on XE.com or similar sites before you travel, then use that knowledge to evaluate your options.

When someone offers you a rate that’s significantly worse than what you researched, you’ll know to walk away.

Avoid Dynamic Currency Conversion

When using your card abroad, merchants sometimes offer to charge you in US dollars instead of the local currency. This might seem helpful, but it’s actually a costly trap called dynamic currency conversion.

Always choose to pay in the local currency – your bank’s exchange rate will be much better than the merchant’s conversion rate.

Get a Card with No Foreign Transaction Fees

Many credit cards charge 2–3% fees on every foreign purchase, which adds up quickly on a long trip. Several banks now offer cards with no foreign transaction fees, which can save you hundreds of dollars depending on your spending.

Do the math – even if there’s an annual fee, it might pay for itself on one international trip.

Like Travel Pug’s content? Follow us on MSN.

Exchange Large Amounts at Once

Currency exchange services often offer better rates for larger transactions because the fixed fees get spread across more money. Instead of exchanging small amounts multiple times, calculate how much cash you’ll need for your entire trip and exchange it in one or two larger transactions.

The per-dollar cost usually drops significantly with bigger exchanges.

Avoid Hotel Currency Exchange

Hotels offer currency exchange as a convenience service, but they’re not in the money-changing business to help you save. Their rates are typically terrible, sometimes even worse than airports.

Use hotel exchange only in genuine emergencies when you have no other options and need cash immediately.

Research Local Banking Partnerships

Some US banks have partnerships with foreign banks that reduce or eliminate ATM fees for their customers. Bank of America customers can use Deutsche Bank ATMs in Europe without fees, for example.

Check if your bank has similar partnerships in your destination country before you leave.

Like Travel Pug’s content? Follow us on MSN.

Keep Some US Dollars for Backup

Certain countries prefer US dollars over their own currency, and having some American cash can be useful in emergencies. Small bills are especially handy for tips, taxi rides, or situations where cards aren’t accepted.

Just don’t rely entirely on US dollars—you’ll often get poor exchange rates from merchants.

Time Your Exchange Strategically

Exchange rates move up and down based on economic news and market conditions. If you’re planning a trip months in advance and see favorable rates, consider exchanging some money early.

Conversely, if rates are particularly bad, you might wait a few weeks to see if they improve before your departure.

Use Local Banks at Your Destination

Local banks in your destination country often offer better exchange rates than tourist-focused services. They’re also more likely to have fair fees and transparent pricing.

Look for major national banks rather than small local institutions, as they typically have more competitive rates and English-speaking staff.

Like Travel Pug’s content? Follow us on MSN.

Calculate the True Cost of Convenience

Those currency exchange kiosks in shopping centers and tourist areas charge premium prices for their convenient locations. Before using them, calculate the total cost including their poor exchange rate plus any fees. Often you’ll find that a short trip to a proper bank or ATM saves you enough money to pay for a nice meal.

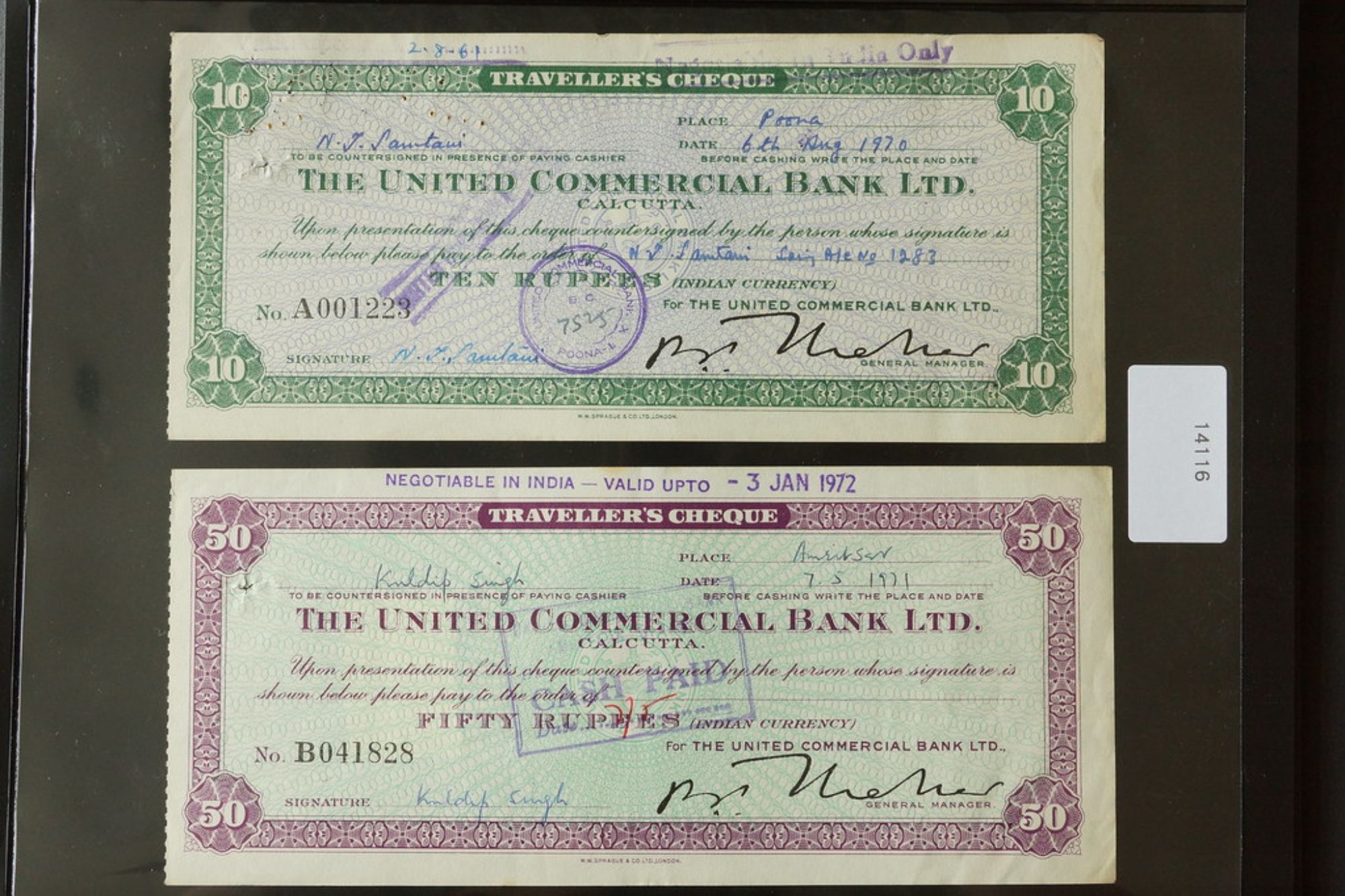

Avoid Traveler’s Checks

Traveler’s checks were once the safe way to carry money internationally, but they’re now mostly obsolete and expensive. Many places won’t accept them anymore, and the fees for purchasing and cashing them eat into your budget.

Modern debit and credit cards with fraud protection are safer and much more convenient.

Don’t Exchange Money Back at the End

Converting leftover foreign currency back to dollars usually involves poor exchange rates and additional fees that make it a losing proposition. Instead, save small amounts of foreign currency as souvenirs, or spend your remaining cash on last-minute purchases at the airport.

The conversion fees often cost more than just keeping the foreign money.

Like Travel Pug’s content? Follow us on MSN.

Smart Money Moves for Savvy Travelers

Currency exchange doesn’t have to be a mysterious process that drains your travel budget through hidden fees and poor rates. These strategies help you keep more of your money for actual travel experiences instead of banking fees.

The key is planning ahead, understanding your options, and avoiding the convenient but expensive choices that prey on unprepared travelers. With a little effort and the right approach, you can save enough on currency exchange to fund an extra day or two of your adventure.

More from Travel Pug

- 20 Best Beach Towns in the Carolinas

- 13 Destinations Where Tourists Regularly Regret Their Trip

- 20 Destinations That Are More Magical Without an Itinerary

- 20 Underrated Adventures That Belong on Your Travel List

- 20 Cities Where You Should Just Wing It, No Planning Required

Like Travel Pug’s content? Follow us on MSN.